WMB Fast Quotation The Williams Companies, Inc. On February 20, WMB – Free Report) will announce its fourth-quarter results. The current Zacks Consensus Estimate calls for a profit of 47 cents per share on $3.2 billion in revenues for the quarter that has yet to be reported.

Let’s investigate the variables that might have affected the December quarter’s performance for the operator of the oil and gas pipeline. Yet, it’s important to first review Williams’ results from the prior quarter.

Highlights of Q3 Earnings & History of Surprises

On the strength of robust performance across its core businesses in the most recent reported quarter, the energy infrastructure provider outperformed expectations. In comparison to the 44-cent Zacks Consensus Estimate, Williams had posted adjusted profits per share of 48 cents. Moreover, the company’s $3 billion in revenue was 5.4% higher than expected.

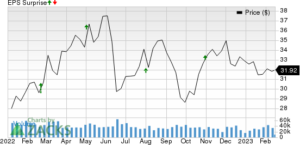

In each of the previous four quarters, WMB exceeded the Zacks Consensus Estimate for earnings, delivering an average earnings surprise of 14.2%. The graph below shows how this works:

Williams Companies, Inc. (The)

Price and EPS Surprise

Current Estimate Revision Trend

In the previous seven days, there has been no change in the fourth-quarter bottom line, Zacks Consensus Estimate. The predicted number shows a 20.5% increase from the previous year. Yet, the revenue Zacks Consensus Estimate predicts a 2.4% decline over the comparable period.

Factors to Consider

The largest and fastest-growing natural gas pipeline system in the country, Transco, is a part of Williams’ Transmission & Gulf of Mexico sector, which is estimated to have produced considerable earnings in the fourth quarter.

The installation of expansion projects near Transco over the past few years, as well as increased volumes from its infrastructure as a result of vigorous drilling activity, are likely to have helped the unit. The segment’s adjusted EBITDA is expected to reach $697 million in the to-be-reported quarter, up from $685 million in the same quarter last year, according to the Zacks Consensus Estimate.

It is anticipated that the Northeast G&P unit, which operates in the Marcellus and Utica shale basins and engages in the collection, processing, and fractionation of natural gas, did well in the quarter that would be reported. The Zacks Consensus Estimate for the quarter’s adjusted EBITDA is estimated at $465 million, reflecting the segment’s positive characteristics. The figure indicates a $6 million rise over the $459 million profit reported in the prior quarter.

A potentially negative point is that the company’s to-be-report bottom line may have suffered due to the increase in Williams’ costs. The third quarter saw an increase of about 4% in WMB’s overall costs to $2.2 billion. Due to the ongoing inflationary environment, the higher cost trajectory is likely to have persisted in the fourth quarter.

What Says Our Model, Exactly?

Williams Companies is not likely to beat expectations in the fourth quarter, according to the tried-and-true Zacks methodology. The likelihood of exceeding estimates increases when a stock has a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) and a positive Earnings ESP. Nevertheless, this time, it’s different.

Our Earnings ESP Filter will help you identify the best stocks to buy or sell before they are reporting.

The difference between the Most Accurate Estimate and the Zacks Consensus Estimate, or earnings ESP, is -6.07% for this company.

WMB has a #3 Zacks Rank at the moment.

Consideration for Stocks

Based on our model, you might want to take a look at the following energy sector companies, even though an earnings beat for WMB appears improbable:

The Zacks Rank #1 and +21.30% Earnings ESP of ProPetro Holding Corp. (PUMP Quick QuotePUMP – Free Report) speak for themselves. On February 21, the company will announce its financial results.

The full list of stocks with a Zacks #1 Rank as of just this moment is available here.

ProPetro Holding anticipates 596.1% earnings growth for 2023. PUMP, a $1.2 billion company, has lost 19.9% in the past 12 months.

The company Par Pacific Holdings, Inc. (PARR Quick Quote

The Zacks Rank #1 of PARR (Free Report) and its Earnings ESP of +6.79%. The company is expect to announce its earnings on February 22.

Par Pacific Holdings anticipates 539 percent earnings growth for 2022. PARR, now valued at almost $1.7 billion, has increased by 87.6% in a year.

Cheniere Energy (LNG Quick Quote LNG – Free Report) has a Zacks Rank #3 and an Earnings ESP of +18.82%. The company is expect to announce its profits on February 23.

The expected earnings growth rate for LNG in 2023 is 539.1%. With over $37 billion in value, LNG has increased by 27.3% in a year.

Use the Zacks Earnings Calendar to stay informed about impending earnings reports.https://moneydigitals.com

Free Research Reveals How to Benefit from the Rising Electric Car Market

Even after setting records in 2021, sales of electric vehicles around the world continue to climb remarkably. His desire has been spurred by high petrol prices as well as the advancement of EV comfort, features, and technology. So, the enthusiasm for EVs will persist long after petrol prices return to normal. Not only are manufacturers making record-high profits, but EV-related technology vendors are also doing well financially. Do you understand how to profit? If not, we have the perfect report for you — and it’s FREE! Don’t pass up the opportunity to receive the top 5 electric car revolution stocks from Zacks today for free and without any commitment.https://moneydigitals.com/london-based-crypto-asset-management-arm-to-close-on-blockchain-com/